|

Ghana Politics | Economy - Development Gold revenues leave Ghana untaxed

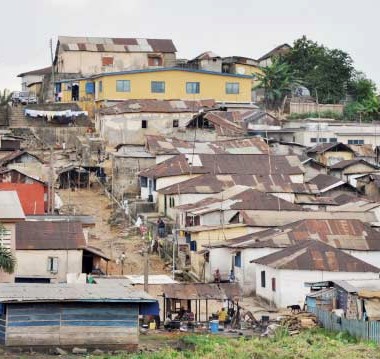

Today, the report "Golden Profits on Ghana's Expense – An example of incoherence in EU policy" was presented by the two Danish NGOs DanWatch and Concord in Copenhagen. As part of an effort to reveal how tax evasion and capital flight from developing countries is outnumbering development aid by a factor of one to ten, the report is a case study of how Ghana sees little revenues from its immense gold riches.

In Ghana, the alleged transfer mispricing and fixed low local revenues also influence royalties of the value of extracted minerals, the other main state revenue from mining companies. Ghana calculates the royalty rate to a minimum of three percent, which is raised accordingly with the company's profits up to a maximum of six percent. Low profits on paper will thus also ensure lower royalty payments, the report holds. The loss in royalty revenues could amount to hundreds of million of euros during the last decade, mining analysts have calculated. According to DanWatch and Concord Denmark, there is little Ghanaian authorities can make to secure their fair share of the profit gathered by multi-national mining companies on their soil. "The current international tax regulation framework makes it impossible to estimate whether the corporations are paying a fair amount of tax to the developing countries, because they are only obliged to produce an annual report which covers the entire corporation group." The two NGOs, joined by a large number of organisations calling for fair trade, are demanding international reforms that would oblige all multi-nationals to produce detailed country-by-country reporting balances. This increased transparency would enable governments and NGOs to better evaluate corporate tax contributions and transfers from mother to daughter companies over international borders. The report also attacks the European Union over its double standards regarding taxation. Many of the world's leading tax havens are on European soil and the EU, in protection of its multi-nationals, has done little to halt this development. Money lost to tax evasion by African countries, indirectly plunged back to the European and North American economy, is calculated to be ten times more than money spent on development aid for Africa. According to new research, in the period 1970 to 2008, Africa lost US$ 854 billion in cumulative capital flight. From 2000 to 2008, illicit outflows from Africa accelerated by 25 percent coinciding with a boom in mineral prices. In addition to country-by-country reporting for multi-nationals, the report calls for sanctions against tax havens in Europe and beyond. Further, Ghana and other developing countries should be assisted in capacity building to help them collect their rightful taxes. By staff writer © afrol News - Create an e-mail alert for Ghana news - Create an e-mail alert for Politics news - Create an e-mail alert for Economy - Development news

On the Afrol News front page now

|

front page

| news

| countries

| archive

| currencies

| news alerts login

| about afrol News

| contact

| advertise

| español

©

afrol News.

Reproducing or buying afrol News' articles.

You can contact us at mail@afrol.com